Green shoots continue to appear across Europe & Australasia, while North American growth stagnates for the first time in 8 weeks

Jun 30, 2020

30th June 2020: As we look to global trends from within CarTrawler, we can see some regional consumer confidence levels are building steadily as restrictions ease, in particular across Europe & Australasia. Business wide, bookings are continuing to grow with +15% increase this week versus last week. This growth trend does not appear to be reflected across the Atlantic, with North American growth slowing.

Europe:

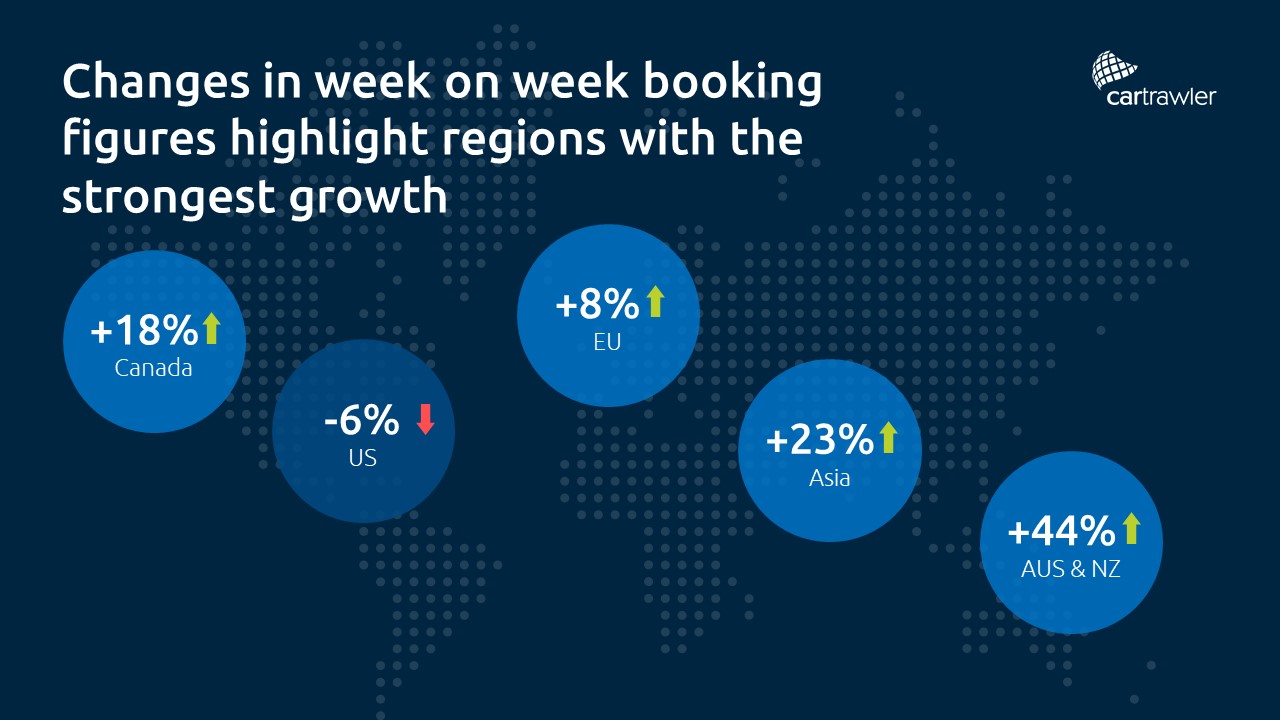

European bookings have continued to grow with 8% increase week on week. This upward trend in European growth could be explained when using data from research published by Oxford University detailing government policies and mobility trends. Domestic travel restrictions in much of central Europe have moved to a ‘No Measures’ status reducing domestic restrictions. This is reflected in booking data when we look at the best-performing countries versus last week Belgium (+60%), Spain (+88%), Netherlands (+30%) and the UK (+27%). This is the first time since early March that UK reservations returned to growth as new bookings increased.

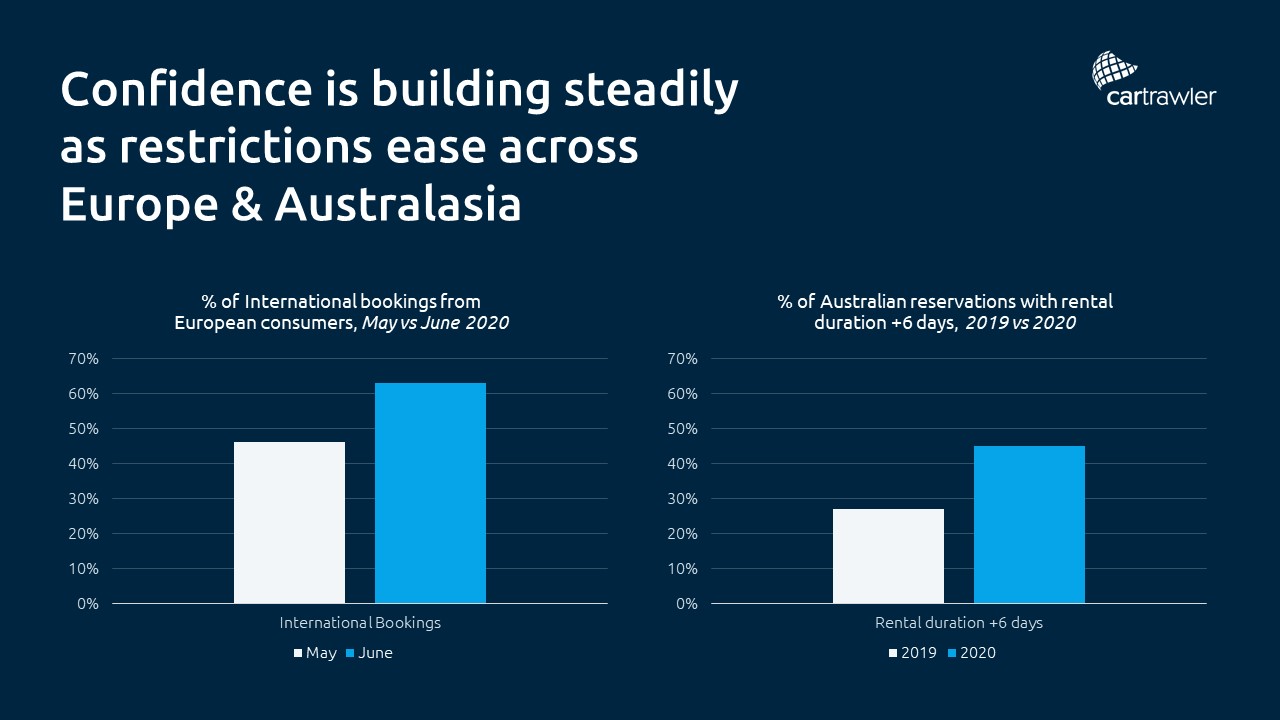

Longer than average rental durations appear to be a continuing trend this week with a total year-on-year increase of +29%. Growth in international travel within mainland Europe also remains strong and there has been a significant upward movement in international bookings. Looking at the percentage split in domestic and international in our booking data, we can see the share of international bookings increasing from the month of May, 46% of bookings were international in May compared to 63% in June.

Australasia:

Booking growth has also continued to increase across Australasia, with a 44% increase week on week.

As the Australian government rolls out a plan to allow domestic interstate travel, bookings saw significant growth with +114% week on week increase in gross bookings. The bulk of these bookings (41%) were made 30-90 days in the future versus just 19% for same period last year. The average rental duration was also high in comparison to the same time period in 2019, 45% of trips booked were for 6+ days compared to 27% in 2019.

North America:

As COVID-19 figures in the US continue to rise, we can see bookings begin to stagnate after 8 weeks of solid week on week growth. There is likely a lot of uncertainty in the market and despite many states beginning to open, the narrative of CV-19 in the US has not improved. Seven US states have reported their highest coronavirus patient admissions in the pandemic so far, as cases surge in the US following the easing of restrictions. This is reflected through consumer behaviour, with bookings this week down -6% versus the previous week.

This reduction in consumer confidence is also reflected in lower numbers of consumers searching for car rental and flight where growth had previously been steady across the board. This week, the search terms appeared to backslide week on week -12pp in the US. Although this week on week drop appears sharp, when compared to two weeks previous the change is not as severe owing to an apparent surge of searches in week of June 7th.

Contrary to US trends, Canadian growth remains consistent, with week on week growth of +18%, and a reduction in car rental search terms of just -3pp. However, it is important to highlight, while the US recovery stalled last week, it still remains ahead of many other markets, incl. Canada. Overall US reservations have grown by 34pp last week compared to their nadir in early April, versus Canada’s growth of 19pp vs their nadir (early April).