Average rental days continued to increase in Europe and Australasia highlighting consumers ever-present desire to travel

Jul 30, 2020

Recovery is continuing to build across all segments as we entered our 12th week of consistent week on week growth. Bookings this week grew by 5% compared to last week. The standout country with strong growth this week was the UK with +17% increase in bookings versus last week, the UK has now experienced double-digit WOW growth for +5 weeks. Other countries to highlight with significant growth on last week are Netherlands +21%, Canada +11% and Switzerland +9%. Cancellations are also trending flat, and there is no such spike or increase to report in recent days or weeks.

International European travel is continuing to rise towards 2019 levels at 71% for July compared to 75% as a pre-COVID average. Across North America the gap is slowly closing, with the international split now at 11%, up from 6% at the Nadir in May, this brings it to just 12pp off the pre-COVID average. Australasian international travel has remained very low at just 3%, still12pp away from the pre-COVID average.

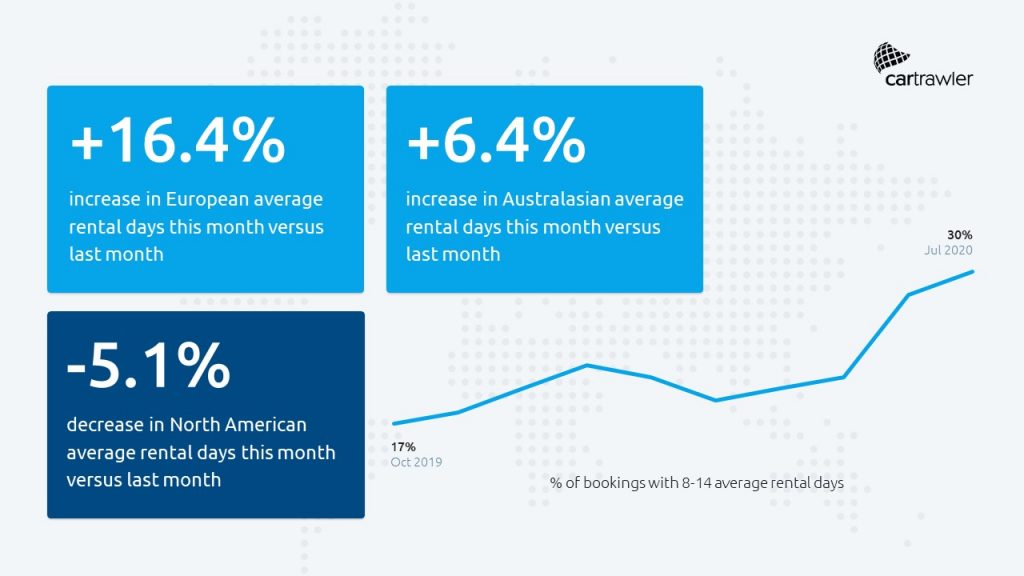

The average rental days per consumer has also continued to increase in Europe and Australasia highlighting consumers’ ever-present desire to travel with 16.4% growth month on month in Europe and 6.4% increase for Australasia. North American bookings tell a different story, for the first-time average rental days have decreased by -5.1% this month versus last month. This may be due to the resurgence in COVID-19 cases stifling demand.

Looking across the market, IATA presented their outlook for flights and passenger numbers over the forthcoming years and their current expectations around the recovery path. At present, air passenger demand is not expected to regain 2019 levels until 2023. IATA noted global daily flight numbers are still below 60% of pre-COVID levels however, they have increased 20ppts from nadir (from c.-80% at worst). US and China supported by stronger domestic markets have seen their regions recover quicker. The relaxation of European restrictions has resulted in a sharp uptick in July. Domestic travel has recovered quicker than international travel as expected. This is driven by the US and China who are domestic heavy markets.