European Airlines Lead a la Carte Revenue Estimate at $31.5 Billion

Feb 18, 2020

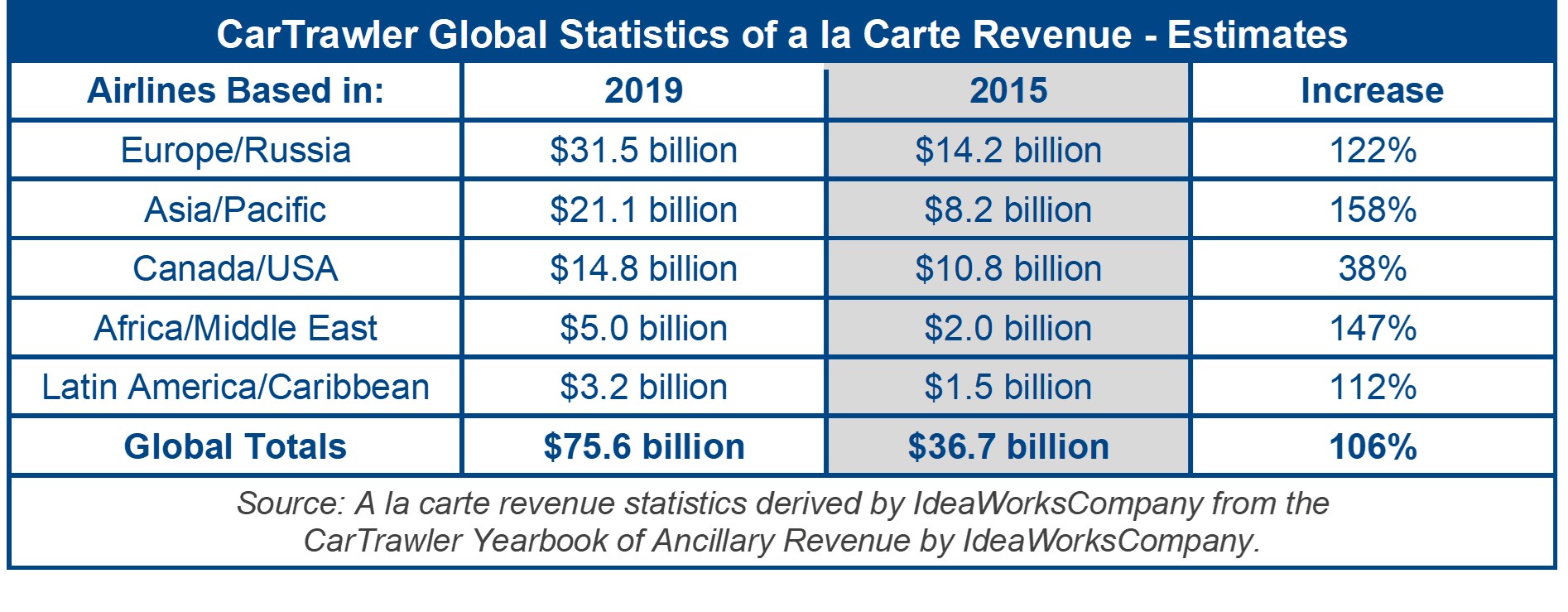

CarTrawler Global Estimate of a la Carte Revenue yields regional details from the worldwide total of $75.6 billion.

Dublin, Ireland & Shorewood, Wisconsin, 18 February 2020: The birthplace of airline a la carte revenue—Europe—continues to lead the globe in annual growth for this key sales component. And the world’s fastest-growing air travel market, Asia, is not far behind.

IdeaWorksCompany, the foremost consultancy on airline ancillary revenues, and CarTrawler, the leading technology platform providing end to end transport solutions for online businesses, recently estimated airline a la carte revenue at $75.6 billion worldwide for 2019. The CarTrawler Global Statistics of a la Carte Revenue adds regional details and 2015 comparisons to the figures from the earlier November 2019 release.

Each year IdeaWorksCompany, through the sponsorship of CarTrawler, analyzes the ancillary revenue disclosures for airlines all over the world. These results are applied to a larger list of carriers (which numbered 160 for 2019) to estimate ancillary revenue activity for the world’s airlines. A la carte activity is a significant component of ancillary revenue and consists of the amenities consumers can add to their air travel experience. These include fees paid for checked baggage, assigned seats, buy-on-board meals, early boarding, and onboard entertainment.

The pace with which ancillary revenue has transformed the airline industry has been exciting to observe

It is beyond doubt now that carriers which prioritise extensive choice architecture and a superior customer experience are significantly increasing their chances of reporting healthy profit margins. The adoption of a sophisticated ancillary revenue strategy must now be seen as a necessary step for all airlines that want to stay relevant as we enter a new decade. We can see from our report that airlines in Europe and the Asia-Pacific regions in particular have embraced this technology with remarkable success, as they realise that owning the last mile is a key component of long-term value for the customer.

Aileen McCormack, Chief Commercial Officer at CarTrawler.

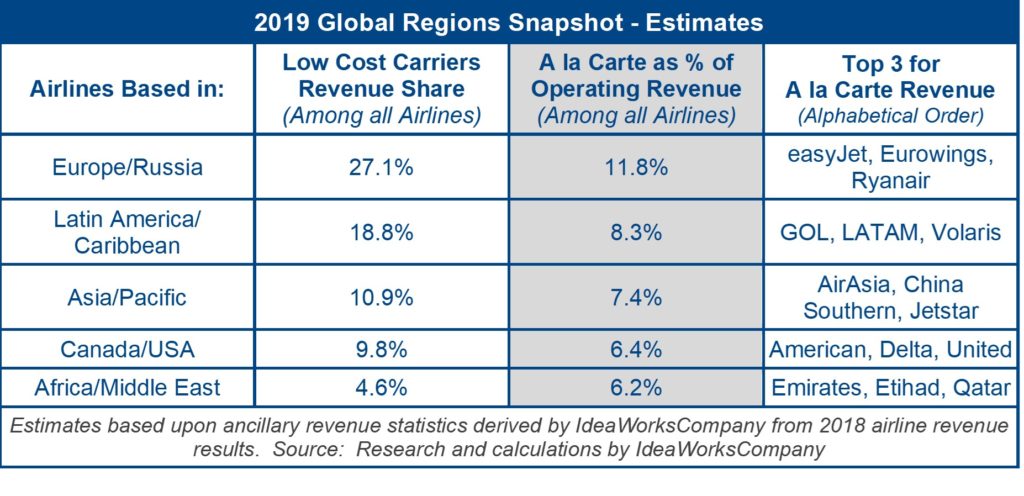

The 2019 Global Regions Snapshot table further demonstrates how a la carte activity varies by region. The prevalence of low cost carriers in a region actually drives the level of ancillary revenue; a higher concentration of low cost carriers (LCCs) boosts ancillary revenue and a la carte results.

- Europe/Russia leads the world for a la carte activity and LCCs generate more than 27% of operating revenue for airlines based in Europe and Russia. Traditional airlines are making moves to increase a la carte activity and have recently been more forthcoming regarding their results. Air France/KLM loyalty members now accrue miles for fees paid for premium meals, seat assignment, and baggage. Aeroflot Group continued the European tradition by introducing basic economy fares in 2019. SAS Scandinavian established a business unit to grow ancillary revenue. Ryanair optimized its checked bag and early boarding service. Lufthansa’s CEO proudly disclosed that ancillary revenue had reached 8% of passenger revenue.

- Canada/USA has lower LCC penetration (at 9.8%) which is reflected in the dominance of the big 4 airlines: American, Delta, Southwest, and United. The a la carte efforts of the global network carriers get a big boost by using basic economy fares (no checked bag, no advance seat assignment, and last to board) as an effective tool to check the threat of domestic LCCs and to bolster a pricing advantage on international routes.

- Within Latin America, Mexico’s LCCs are posting big ancillary revenue results, with Viva Aerobus as a top global performer. Three of the region’s airlines are among the top 15 worldwide for ancillary revenue as a percentage of total revenue: Azul, Viva Aerobus, and Volaris. Young LCCs, such as Amazonas, FlyBondi, JetSMART, Sky Airline, and Wingo, have captured the interest of traditional airlines which are beginning to adopt a la carte methods of LCCs.

- The Asia/Pacific region is also bending towards the a la carte model. Cathay Pacific, Qantas, and Singapore now charge fees for advance seat assignments for consumers buying lower-priced fares. Basic economy fares are now offered by these traditional airlines: China Eastern, Hong Kong Airlines, Malaysian Airlines (domestic routes), Philippine Airlines (domestic routes).

- Africa and Middle East has the lowest share of LCC activity among the regions of the world and as a result, has the lowest level of a la carte activity. But this is changing with Air Arabia, flydubai, Flynas, and Kulula firmly established as low fare enterprises. The region’s leading operator, Emirates, along with Etihad, now charges fees for standard seat assignments for lower-priced economy fares. Wizz Air is coming to the region through a joint venture in Abu Dhabi, and this will certainly bring about an expansion of a la carte activities by incumbent airlines.

The clear lines which once separated traditional airlines and LCCs have become blurred. Traditional airlines built their brand on an all-inclusive service with economy fares that included a checked bag, pre-assigned seating, and the ability to make reservation changes. This is changing through the growing adoption of basic economy fares. Etihad Airways, which is routinely ranked among the world’s best for service, now generates a la carte revenue from standard seat assignments, first class lounge access, Wifi service, and premium snack items in the economy cabin. Meanwhile, LCCs increasingly aim for business travelers, which is a core market for traditional airlines.

EasyJet’s Plus membership provides early boarding, fast track security, extra leg room seats, and express bag drop. The only items missing from the offer are lounge access and a glass of sparkling wine. Oh wait . . . those are available as a la carte services also sold by easyJet. This is the magic of the a la carte method. It frees airlines from rigidly providing the same perks for all economy passengers. Instead, passengers can click and choose the comfort and convenience that best meets their needs and budget. The revenue increase of 106% from 2015 to 2019 is solid proof a la carte sales and ancillary revenue work for consumers and airlines throughout the world.